Understanding risk

Investing involves taking risks with your money. It is vital that you understand the risks you are taking and why you are taking them.

Risk is about how much uncertainty you are likely to experience during your investment journey.

In general, there is a direct relationship between risk and potential returns. Riskier investments tend to have the potential for higher long-term returns – and for greater losses along the way. Understanding this trade-off is essential when setting realistic investment goals.

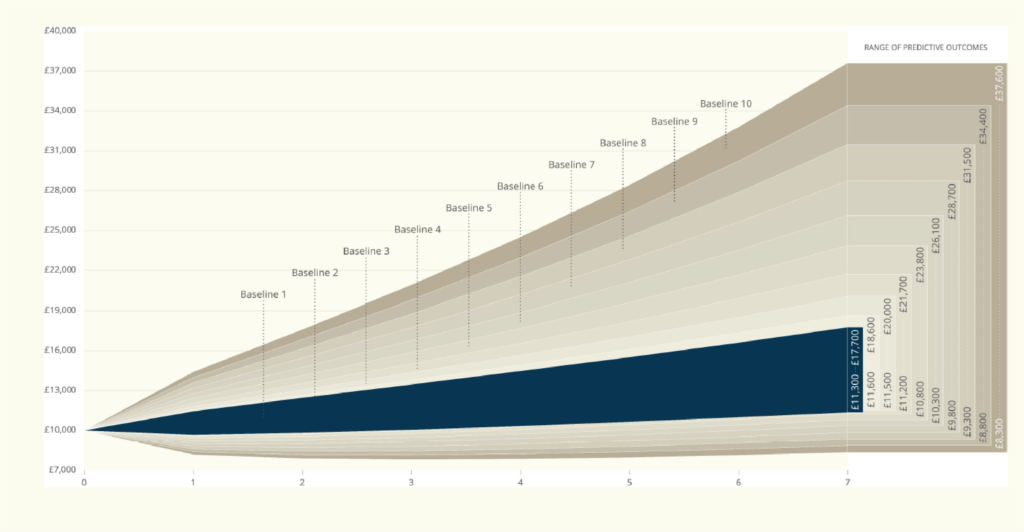

The likely trade-off between risk and returns is illustrated below. It shows how much £10,000 invested today might grow to in XX years depending on which of the MKC Baseline Benchmarks your portfolio aims to beat.

Time is also a factor. The longer you are invested, the more risk you may be able to accept, because your investments have more time to recover from market downturns.

Cash may sound safe, but it does come with some risks. If the rate of inflation is higher than the interest earned on your cash, the real value of your money decreases. Over the long term, the average annual return of stock market investments has usually outpaced the rate of return on cash or cash equivalents.

Before investing you need to work out your risk tolerance or risk level. This is the extent to which you are able and willing to withstand fluctuations in the value of your investments and your potential return. It will depend on factors such as your financial goals and time-scale, your general attitude to risk and how much you are prepared to lose.

The MKC Invest difference

Each portfolio is available to suit five MKC Invest investor risk profiles:

- cautious

- moderately cautious

- balanced

- moderately adventurous

- adventurous.

The returns you could achieve will vary according to your risk profile. We want everyone who placed their money in our portfolios to have selected the right risk profile for their circumstances. This is one of the reasons our portfolios are only available through financial planners.

Your financial planner will help you work out:

- if one or more of our range of portfolios is right for you

- if it is, work out how much risk you are willing and able to take and your MKC Invest risk profile

- select the portfolio within the range that corresponds to your agreed risk profile.

Our portfolios are only available through professional financial planners.

To speak to someone call 020 7702 4488 or email enquiries@mkc-invest.com.