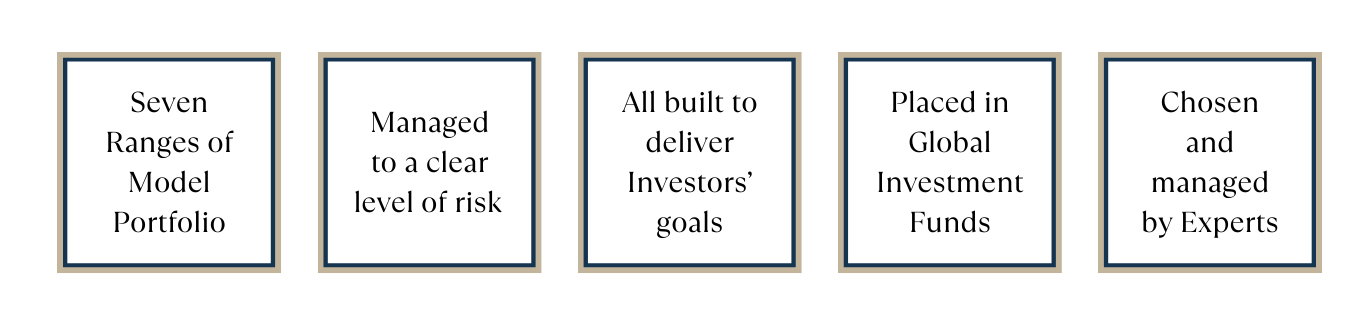

What is a model portfolio?

A model portfolio is like a basket: it holds a diverse range of investment funds.

The portfolio manager chooses funds they believe will enable each portfolio to meet and remain within its stated investment objectives and risk level parameters. To achieve this they may spread your money across different asset classes, sectors and geographic regions. The manager changes the funds in the portfolios when they think doing so will give the portfolios a better chance of meeting their mandates.

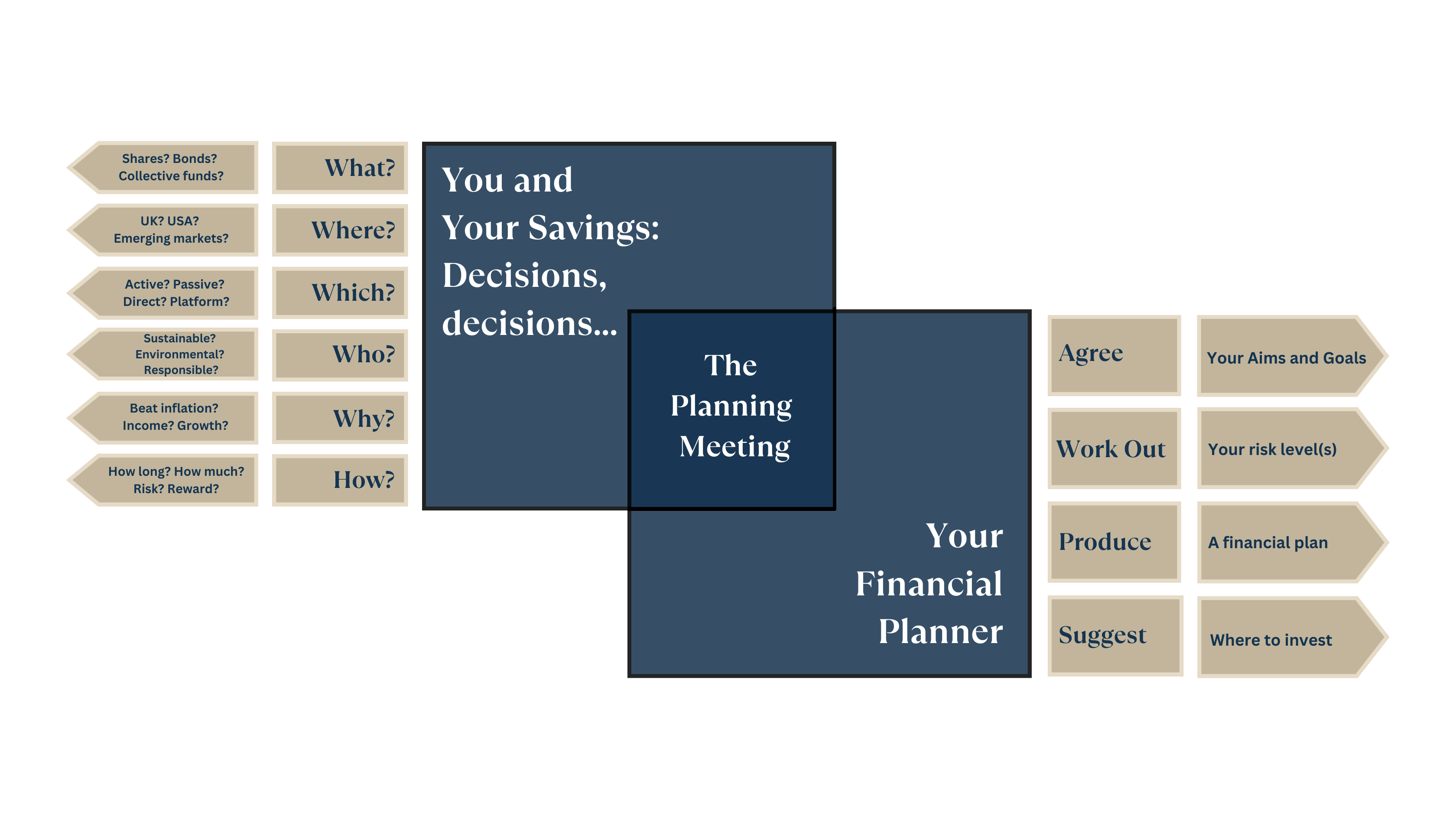

The benefits of taking professional advice

Deciding how and where to invest your money to give it the best chance of achieving your objectives involves taking into account a number of factors. Some relate directly to you, for example how long you are investing for or whether you want your investments to be environmentally-friendly. Others relate to external factors such as global markets or the costs you pay.

That is why we believe that investing is best done with the help of a qualified, independent financial planner. They will guide you through the myriad of issues you should take into account and recommend the options they consider a good match to your preferences and goals.

We create and manage model portfolios for private investors

We currently offer seven types of portfolios. Each caters for a specific set of investor preferences and has agreed rules and goals.

When you choose one of our portfolios you grant us authority to make investment decisions without asking for approval. That is why we are called a discretionary portfolio manager: you leave the day-to-day decisions involved in managing the portfolios to our discretion or judgement.

See how we measure our performance

Our portfolios are only available through professional financial planners.

To speak to someone call 020 7702 4488 or email enquiries@mkc-invest.com.