Benchmarks: how we measure our performance

Discretionary model portfolios need benchmarks so that anyone can see how each portfolio is performing.

A few types of benchmarks are available, including those based on:

- a sector or “peer group” of other investment managers

- an economic indicator, like interest rates or inflation

- a fixed annual return, for example “5% per year”

- a market or index of shares or other assets, such as the FTSE 100 or S&P 500.

The MKC Invest difference

We think that our performance should be judged against the agreed objectives and risk levels of each portfolio. And we want to be free to do what we think is best for our clients. It seems to us that trying to do better than benchmarks that mirror the views and actions of other investment managers is likely to prevent us from achieving this. We therefore decided to create our own benchmarks. We wanted them to:

- be simple and easy to understand

- be made of assets you can actually invest in

- not be driven by the behaviour of other investment firms

- be chosen by us, not by a third party.

We noticed that simple benchmarks that combine global shares and global bonds have done significantly better than the Investment Association’s most popular mixed asset peer groups over most time periods.

This got us thinking: why measure ourselves against a group of other investment managers who collectively seem unable to beat global markets over time? Surely it makes more sense to measure ourselves directly against those global markets instead?

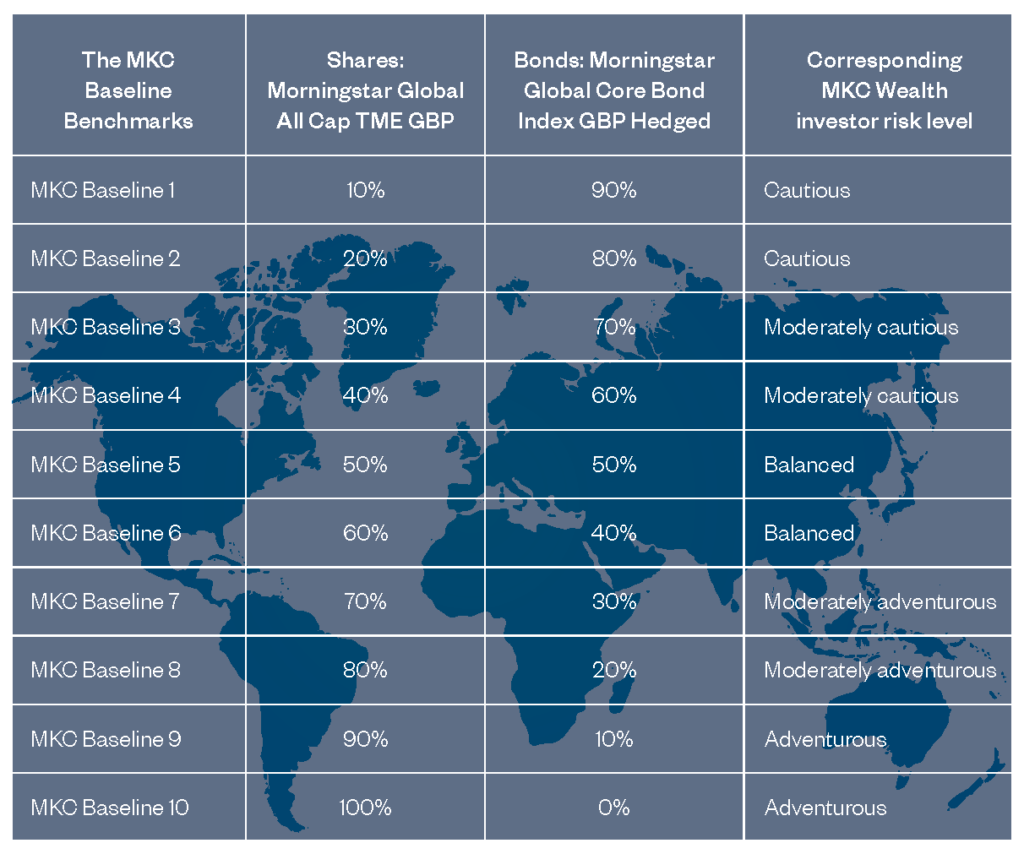

We reduced this idea to its simplest form: one index that tracks global shares and one index that tracks global bonds. We decided to use indices provided by Morningstar, a research partner we know and trust.

We have ten benchmarks. Each is made up of these two indices in different fixed percentages. We call them the MKC Invest Baseline Benchmarks. They apply to all the portfolios in all our ranges as shown in the table below.

Our portfolios are only available through professional financial planners.

To speak to someone call 020 7702 4488 or email enquiries@mkc-invest.com.